Back to the Learning Academy.

Investors and Companies are Paying Attention to Human Capital

Human Capital ("HC") is the skills, knowledge, and experience possessed by an individual or population, viewed in terms of their value or cost to an organization. Human Capital Management ("HCM") as it relates to public companies, is the process of managing, recruiting, developing and optimizing employees to increase productivity, and in turn, a company's value.

The concept of HC is not new. Economists have long discussed the real expense of training and educating a workforce and thus increasing the welfare of society, and also treating HC as part of the income stream, despite the intangibility of it. Studies show that firms with superior HCM are better positioned to create resources and capabilities, which translates into outperformance and economic value for shareholders.

With an increased focus on ESG in recent years, HCM has also come on investor radar screens leading issuers to consider what HC metrics to include in their disclosure. Two years ago, the SEC mandated disclosure from U.S. reporting companies to include any HC measure that is "material to an understanding of the registrant's business". However, without a mandated framework, there has been a wide variety of metrics disclosed. The SASB and NFRD frameworks do include HC related topics but by no means have they established a standard when it comes to reporting HC in companies' continuous disclosure and/or sustainability reports. Canada hasn't mandated disclosure of HC metrics, which has resulted in variable disclosure versus best practices among public companies. Institutional investors, like Blackrock, have made HC a priority engagement issue with their portfolio companies and, without mandated frameworks, it's institutions that are signaling what HC themes contribute to value.

Blackrock's Investment Stewardship Global Principles, considers that the interests of key stakeholders supports a companies' ability to deliver long term financial results; and that companies that build strong relationships with stakeholders are more likely to meet their own long term strategic objectives. In this light, Blackrock expects companies to disclose how they consider the interests of their work force in decision making, and that HCM is a core investment issue, especially considering that no relationship has been changed more by the pandemic than the employer/employee relationship.

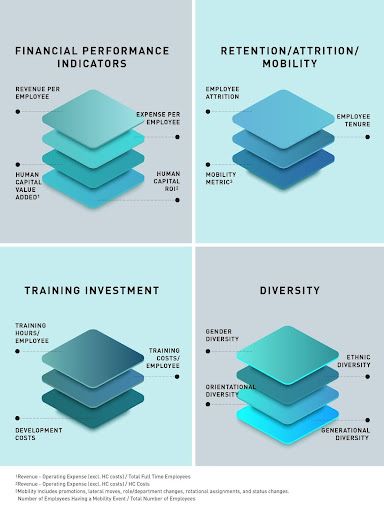

Without strong guidance, the question that arises is what specific HC metrics should issuers disclose? The diagram below, which was re-imagined from The Handbook of Board Governance, outlines four broad themes, and correlating metrics, that are a strong starting point to your HC disclosure.

The disclosure of HC metrics remains low across public companies in Canada, however, some of the metrics outlined above can be found across several continuous disclosure documents, including: the sustainability report, the annual/quarterly financials, MD&A, and the Annual Information Form. In consideration of that, we've included some examples of HC disclosures from TSX listed companies.

- Cenovus Energy, ESG Report, turnover statistics, page 26

- TD Bank Group ESG Report, training statistics, page 78-79

- CIBC, 2021 ESG Report, absenteeism statistics, page 42

- Toromont Industries, 2021 Annual Report, revenue per employee, page 27

- Shopify, 2021 ESG Report, diversity statistics, page 30-33

Effective and transparent disclosure of HC metrics provides stakeholders with a lens to quantify how an organization positions itself to create resources and opportunities. Investors realize that this can translate into shareholder value.