Back to the Learning Academy.

What you Don’t Know About D&O - Overview

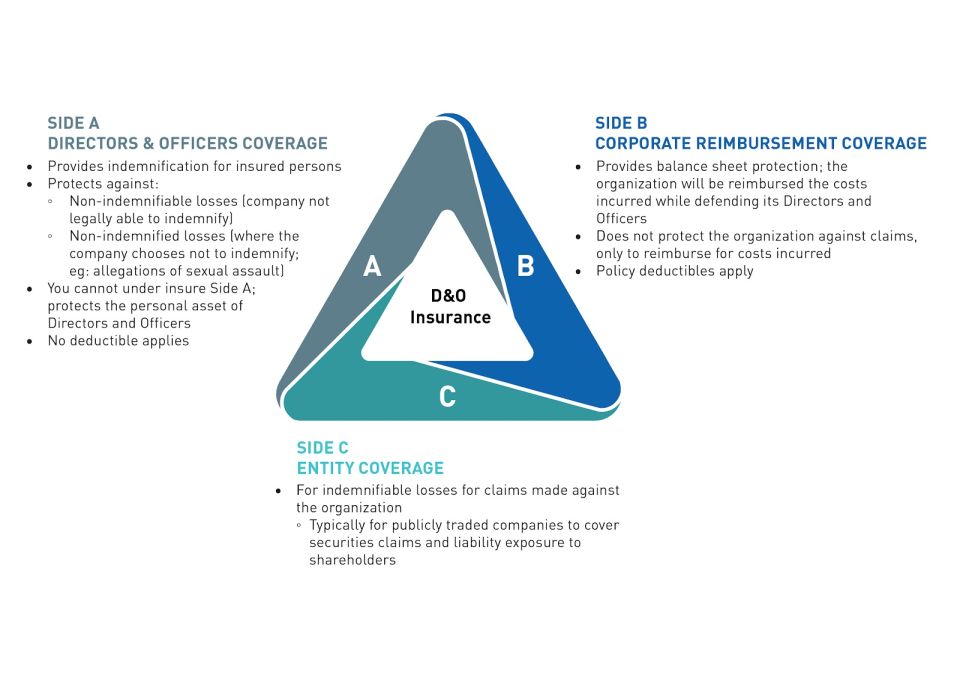

Directors and Officers (D&O) Liability insurance is needed by every company as it protects the organization, Directors and Officers from personal or corporate financial loss that results from any wrongful act committed, or allegedly committed. This article is a quick overview of D&O insurance for issuers and adapted from the discussion with our guests on the podcast, What you don't know about D&O.

| What is D&O insurance? | Why do companies need D&O insurance? | When is D&O insurance needed? |

|---|---|---|

| D&O insurance protects the organization, Directors and Officers from personal or corporate financial loss that results from any wrongful act committed, or allegedly committed. | It provides protection to its Directors and Officers when they are not otherwise indemnified by the corporation eg. insolvency. It may also contain provisions for reimbursement where the company has indemnified its Directors and Officers. | Prior to the insurance coverage itself, every Director and Officer of the organization and all subsidiaries should be indemnified under the organizations (or subsidiary) by-laws. Additionally, each Director and Officer should have an indemnification agreement with the organization (or subsidiary), and be covered by the organization's D&O Insurance Policy. |

Copyright © 2023 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The Future is Yours to See., TMX, the TMX design, and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc.