Overview

Operating as an electronic call market, the TSX MOC facility aims to provide equal access and opportunity for investors looking to source liquidity and participate in trades at the closing price, efficiency and accuracy in setting the closing price, and reduced volatility at the close.

In 2019, based on industry feedback, TMX’s equity markets team embarked on a large-scale consultation process to explore ways in which we could improve the TSX MOC facility. TMX’s ongoing commitment to providing fair and transparent markets for all participants requires a measured and thoughtful approach, considering the interests of the full scope of participants and gauging the potential impacts proposed changes will have on the broader ecosystem.

The New TSX MOC Model

TMX is confident that the significant efforts undertaken alongside our client community to reimagine our TSX MOC facility will reap wide-reaching and long-lasting benefits.

The new TSX MOC model introduces three high level changes, each designed to address the issues of transparency, alignment with global markets, and consistency of execution:

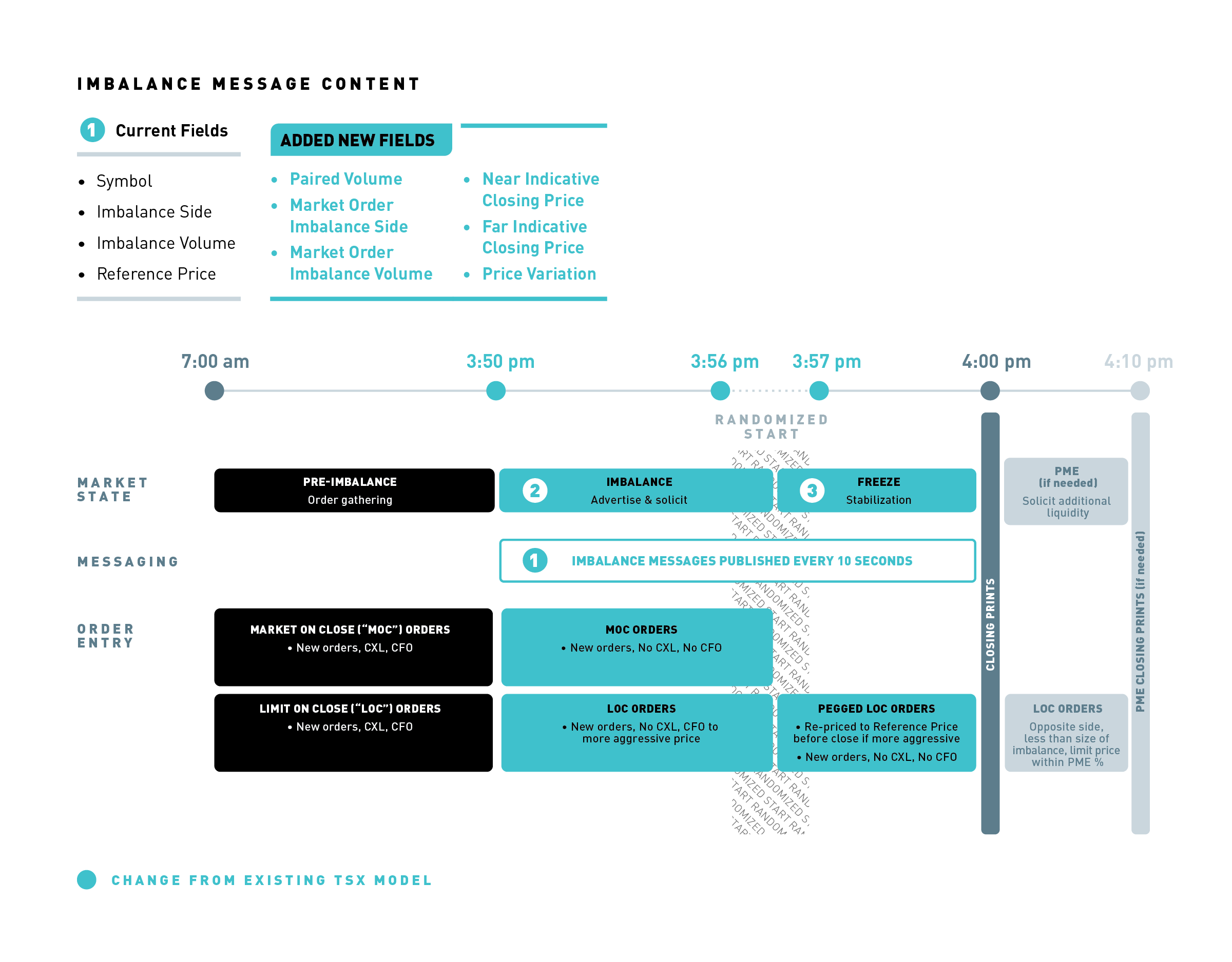

Add 6 new fields of indicative TSX MOC information (currently 4 fields only)

3:50pm

(currently 3:40 pm)(currently no new Market on Close orders allowed)

(currently limited to Limit on Close orders with side, volume and price restrictions)

MOC® | Model Diagram

Market On Close

At 3:50 pm ET the surplus/demand for Market On Close (MOC) orders on TSXV MOC eligible stocks are calculated and published to the marketplace every 10 seconds until close. This interest is published in order to solicit offsetting liquidity and promote fair price discovery at the close. This page contains the first TSXV MOC imbalance message containing only the imbalance side, size and reference price. It is intended for use by market participants participating in the TSXV MOC program as a preview. The full MOC Imbalance message, which also includes Paired Volume, Market Order Imbalance Volume, Market Order Imbalance Side, Near Indicative Closing Price, Far Indicative Closing Price, and Price Variation, and is refreshed every 10 seconds, is available through vendor workstations connecting to TSX's real-time data feeds.

- TSX Venture Exchange MOC Imbalances - Price Movement Extension (PME)

- Stocks Eligible for Market On Close

All TMX MOC related information, company information and intraday data are provided by TMX for informational purposes only. Please refer to the associated time stamp on this web page to obtain the page of the data. All times indicated are Eastern Time. TMX and its affiliates do not guarantee the sequence, timeliness, accuracy, or completeness of any MOC related information or other data displayed, and are not liable or responsible in any way for any delays, inaccuracies, or errors in any MOC related information or other data displayed. Prior to making any investment decision, it is recommended that you consult directly with the individual or firm and seek advice from a qualified investment advisor. Neither TMX nor any of its affiliates makes or has made any recommendations regarding the securities or investment services of any person or entity with respect to the content of this web site, including, without limitation, the information available or of the advisability of investing in securities generally for any particular individual.

You agree not to solely rely upon the MOC related information or other data displayed for any trading, business or financial purpose and TSX Venture and its affiliates are not liable or responsible in any way for any damages, losses or costs arising from reliance on this information or incurred as a result of the nonperformance, interruption or termination for any reason whatsoever of the MOC related information or other data.

The MOC facility provides equal access and opportunity in settling the closing price, reduces volatility at the close, and guarantees anonymity of broker numbers and volumes. Download the full list of symbols (TXT).

Updated: July 20, 2023

Resources

Additional Resources

Equities Trading Notices

2021-007 - TSX MOC Modernization Launch Date and Specifications Availability (March 25, 2021)

2021-002 - TSX MOC Modernization Proposal Receives Regulatory Approval (January 28, 2021)

2021-021 - TSX MOC Modernization Proposal Filed for Regulatory Approval (October 15, 2020)

2021-017 - TMX Equities Publishes TSX MOC Proposal (July 22, 2020)

TSX MOC Imbalances - Price Movement Extension (PME)

Stocks Eligible for Market On Close