Create Disclosure

The importance of ESG disclosure is evident - external pressures for more sustainable practices are balanced with the internal benefits of adopting a sustainable practice. Through an ESG-lens, companies are finding cost-savings, new innovations, preferential finance terms, as well as new customer and employee attraction and loyalty.

Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV) regularly consult with their stakeholders to discuss the evolving sustainability, governance and disclosure standards. This includes engagement with the International Sustainability Standards Board (ISSB), the Canadian Sustainability Standards Board (CSSB), and the Canadian Securities Administrators (CSA) on the national adoption of standards appropriately calibrated for Canadian capital markets.

To help issuers with their sustainability journey, TSX and TSXV recommend the voluntary use of an international standard such as those by the ISSB and CSSB. TSX and TSXV are committed to continue to create specialized resources to assist with ESG disclosure.

Often the question of where to start is asked by issuers. Three concepts are often discussed first:

- A materiality assessment to understand the sustainability concerns and issues top of mind within your company and sector from stakeholders both within and outside your company.

- Governance structure to ensure there is sufficient oversight and accountability to best address the sustainability issues and the strategies to address them.

- For climate specifically, an operational greenhouse gas (GHG) assessment to baseline emissions and identify where and how to look for emission reductions.

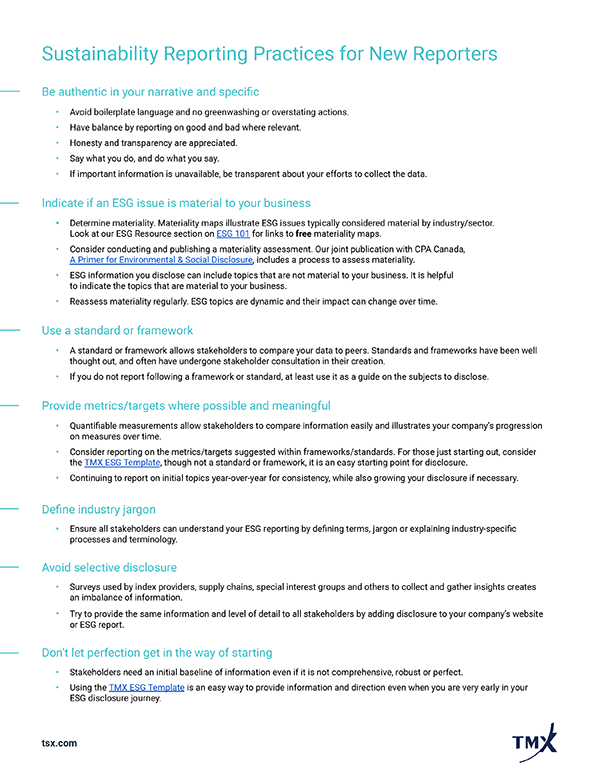

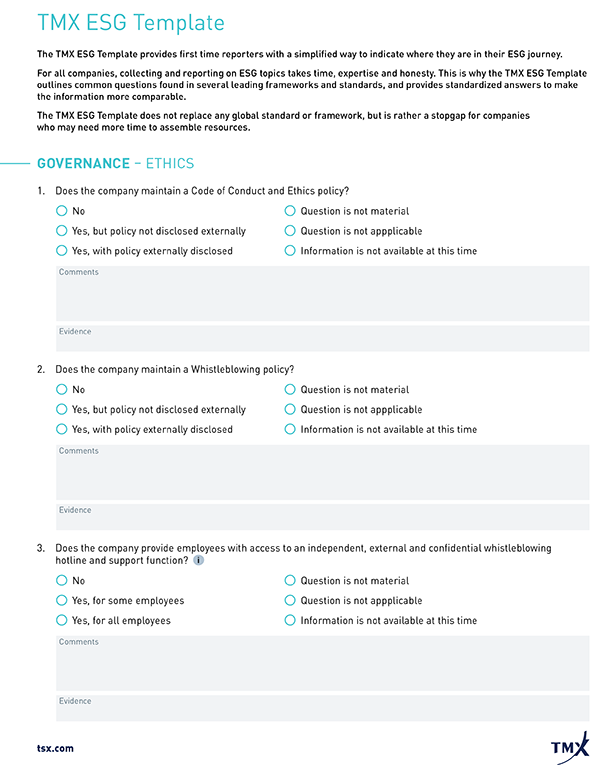

Disclosure Guidance

ESG Insights

More Info

Contact Us

For more information, please contact issuer.services@tmx.com